Industry News

The new development pattern of the automotive aftermarket

On April 23, 2020 New Pattern - Auto Dealership Industry Blue Book Forum and 2019-2020 Blue Book Release Fourth "After-sale" webcast, China Automobile Dealers Association After-sale Service Branch took "New Pattern of Auto After-sale Market Development" as the theme , shared with the audience and industry guests the analysis and thinking on the development and transformation of the automotive aftermarket, and conducted an in-depth analysis of the main characteristics and trends of the automotive aftermarket, as well as the pain points and changes faced by the industry.

1. The growth rate of the automotive after-sales market has slowed down

As the domestic auto market experienced a decline in production and sales in the past two years, the growth rate of car ownership has begun to slow down, which has had a certain inhibitory effect on the further expansion of the automotive after-sales market from the demand side. Therefore, the growth rate of the automotive after-sales market in 2019 Decline, the automotive aftermarket has entered the "stock era".

2. The automobile market has formed a situation of "revenue depends on sales, profit depends on after-sales"

In 2019, about 70% of dealers' revenue came from new car sales on average, but the contribution of new car sales to dealers' profits declined significantly, while the proportion of after-sales business profits increased significantly. Although the dominant position of the sales side in the overall revenue structure of dealers will not change in the short term, new car sales have entered the era of "low profit", and it has become the norm for dealers to make profits from after-sales business.

3. The contribution of new cars and after-sales to dealers’ revenue and profits is clearly differentiated

From the perspective of income, whether it is a luxury/imported brand, or a joint venture or self-owned brand, at least 60% of the dealers' income comes from new car sales, and the contribution of after-sales business to the overall income of luxury/imported brand dealers is higher than that of joint ventures and self-owned brands.

From the point of view of profit, new car sales make a "negative contribution" to the overall profit of joint venture brand dealers. In this context, the compensation of after-sales profit to sales profit is crucial for dealers, and the overall profit of luxury/imported brand dealers is also very important. Very dependent on the contribution of the after-sales business.

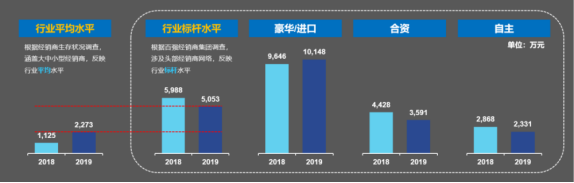

4. There is a significant gap between the industry average and the benchmark level of dealers' after-sales output value

In 2019, the average single-store after-sales output value of dealers increased significantly. The industry benchmark reflects the after-sales output value of the top dealer group. This indicator has decreased year-on-year, but there is still a significant gap between the industry average and the benchmark level, reflecting the small and medium-sized dealerships. There is still a lot of room for improvement in improving after-sales output value.

According to a survey by the Top 100 Dealer Group, the after-sales output value of industry benchmark dealers has shown an overall trend of decline. The average single-store after-sales output value of luxury/imported brand dealers has maintained an upward trend against the trend. Joint ventures and self-owned brands are subject to market fluctuations. The impact is even worse. The average single-store after-sales output value entered a declining channel in 2019, which was not only lower than the industry average, but also further widened the gap with luxury/imported brands in after-sales output value.

5. The proportion of the output value of accident vehicle maintenance has increased

According to the survey of the Top 100 Dealer Groups, in 2019, the proportion of the output value of insurance repairs in the after-sales output value structure of dealers increased, which further enhanced the status and importance of accident vehicle maintenance in the after-sales business revenue of dealers. Imported brand dealers accounted for more than 50% of the output value of accident vehicle maintenance. Considering that the accident car body spray business is easily affected by factors such as consumer driving habits and usage environment, the output value may be unstable with the short-term changes and medium and long-term influences of external factors.

6. The key to improving after-sales output value lies in expanding base customers and reducing customer churn rate

7. The key to improving after-sales output value lies in expanding base customers and reducing customer churn rate. There is a certain correlation between the two. On the one hand, expanding base customers requires continuous and stable new users, and on the other hand, it needs to reduce customer churn. Against the background of declining new car sales, the importance of reducing customer churn rate to stabilizing customer retention and increasing after-sales output value is highlighted. Considering that customer churn usually occurs after the warranty expires, auto manufacturers should strengthen the promotion and popularization of service marketing products such as extended warranty and maintenance packages to improve customer retention.

Regarding the industry pain points of the automotive after-sales market and the changes it will face in the future, the China Automobile Dealers Association After-sales Service Branch summarized four pain points and three major changes in the live broadcast.

Source of information: Tencent.com